Experienced investors focus on adding multi-family properties to their portfolio. This is evident in the high demand for this type of property across Massachusetts. If you’re not sure whether this is the right investment option for you, consider these 5 reasons to invest in multi-family real estate.

1 – Diversification

The stock market can be unpredictable. It’s performing strong right now, but we’ve certainly seen dramatic dips over the years. It’s risky to place all of your investment dollars into just the stock market. Real estate is a great way to diversify. It’s also historically stable with a distinct upward trend despite short-term fluctuations. It’s no coincidence that the wealthiest individuals have some type of real estate investment in their portfolio. It’s a proven fact that real estate builds wealth.

2 – Cash Flow

Multi-family rental properties can provide positive cash flow. If you browse through listings on our website, you’ll find a projected cash flow estimate for each property. We evaluate market rents, operating expenses, and mortgage payments to generate this figure. Income from rental properties easily rival stock dividend percentages. Again, it’s a way to diversify without compromising cash flow,… if that’s n important factor in your selection of investment options.

3 – Market Growth

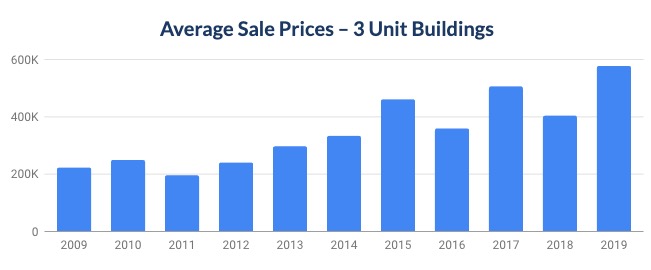

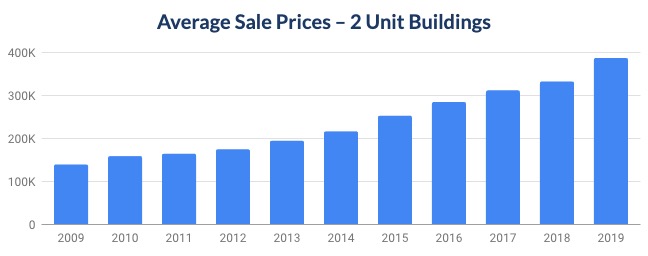

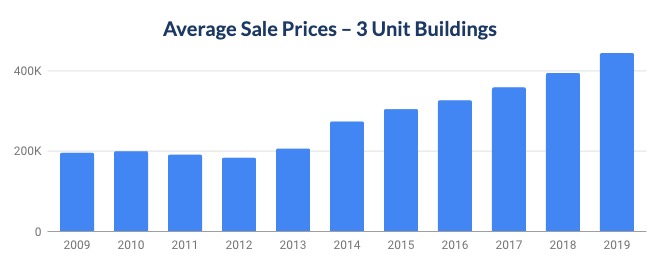

By far, the greatest benefit to real estate investments is increased equity through market growth. Massachusetts has seen dramatic growth over the years. If you visit the town pages across our website network, you’ll see a 10-year comparison chart for all of the major multi-family markets. Here’s a sampling of how some cities have performed.

In Haverhill, two-family properties increased in average price from $141,000 to $389,000. That’s a 175% increase in equity.

In Lowell, three-families increased in value from $197,000 to $446,000 over the last 10 years. A growth of 126%.

Going up to the North Shore to Gloucester, The average value of three-family properties increased 157% from $225,000 to $579,000.

4 – Reduced Risk

Other types of real estate, including single families and condominiums, have had similar growth trends over the years. What makes multi-families more appealing? When you own a condo or single family investment, you rent out to a single tenant. With multi-families, there are multiple units and multiple sources of income. This reduces the risk from potential vacancies.

More Reasons to Invest in Multi-Family Real Estate

The benefits and reasons to invest in multi-family real estate are clear. So, what’s holding you back? If the down payment is an issue, there are sources of down payment funds that you may not have thought of. If debt-to-income ratios are a concern because you own other properties, you’ll be happy to know that mortgage lenders will consider 75% of the rental income when qualifying you for an investment loan. Do you have other concerns? Contact our team to discuss them. The agents in our network work exclusively in the multi-family market and can help you through any issues or concerns that you may have.