How You Can Use Our Website’s Exclusive Investment Tools

If you are reading this article, you already know that investing in multi-family properties can be rewarding. You probably also understand how frustrating that evaluating various investment properties can be based on the rudimentary information provided by most listing brokers.

MutliFamilyProperities.com was built by investors for investors to help them make quick decisions and determine which properties make financial sense for them. While most real estate websites will show you a price and a maybe a cost-per-square-foot, MutliFamilyProperties.com has developed proprietary calculators, estimates and evaluation tools that are specifically designed to help the multi-family investor quickly and efficiently evaluate each property.

Users can set up the site’s advanced search feature to find properties that meet or exceed their minimum requirements on a variety criteria including Cash Return, Capitalization rate, and Condo Conversation Equity. They can then save that search and be alerted instantly when a property that meets their required criteria comes on the market.

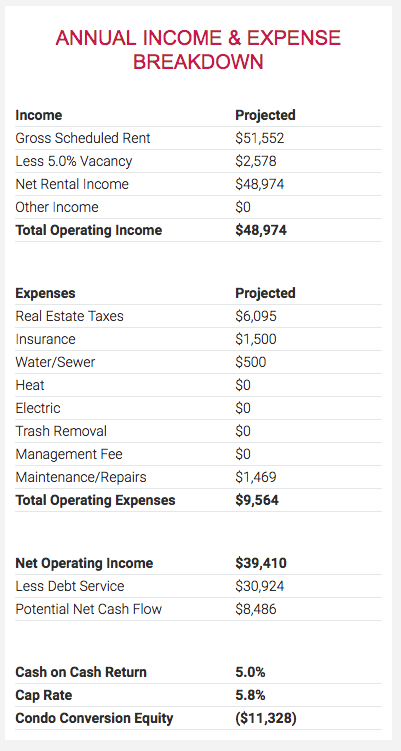

Factoring the Annual Income and Expenses

One unique feature that is found in every listing found on MultiFamilyPproperties.com is a quick overview of that property’s projected annual costs and revenue. We then use those estimates to determine advanced metrics such as Cash Flow, Cash-on-Cash Return, and Cap Rate. Here is how that number is estimated.

Projected Income

Projected Income

MultiFamilyProperites.com looks at gross scheduled rent you can anticipate for the year for all your units. Ideally, all your units will be producing revenue at all times, but in reality, it’s unlikely you’ll have 100% occupancy. It then factors in 5% vacancy rate to cover searching for new tenants, time for repairs/rehab etc. Some properties have other income as well (perhaps an extra garage or parking space). If that’s the case, that is also included in our analysis.

Projected Expenses

There is going to be expenses associated with owning a multi-family. Understanding what those expenses might look like before investing is critical. The Projected Expense estimate is based on a variety of factors:

- Real estate taxes, insurance, water, and sewer are estimated based on similar properties in that town.

- Heat and electric are taken into consideration on properties that have common areas that are the landlord’s responsibility.

- Trash removal is factored in based on the community

- Management fees would also be included if an existing contract was in place that would need to be honored by a new owner. You may choose to hire one or not, but in our analysis, only obligations are included.

- Finally, we estimate maintenance and repairs based on properties of comparable size, the number of units and the community it is located in.

Net Operating Income and Cash Flow

The decision to invest in a multi-family ties up cash and reduces liquidity. Understanding your potential cash flow can be a major factor when choosing to invest or not. To determine cash flow, you subtract the projected expense from the projected income to get your Net Operating Income. From that number, subtract Debt Service (The amount of money required to make payments on the principal and interest on your loan) to determine your potential net Cash Flow for the property for the year. The old saying is that “cash is king” and being able to determine how much you can expect from your investment is a big factor.

Cash-on-Cash Return

Taking the Cash Flow number, you can extrapolate that into a Cash-on-Cash Return. This is the ratio of annual before-tax cash flow to the total amount of cash invested, expressed as a percentage. It is another effective way to evaluate the cash flow from income-producing assets and in our case to determine if the property is a good fit for you.

Capitalization Rate

Another factor investors should consider is Capitalization Rate (commonly called the Cap Rate). The cap rate is another valuable ratio for investors and t factors the Net Operating Income (NOI) to property asset value. If a property Cost $500,000 and had an NOI of $50,000, then the Cap Rate would be $50,000/$500,000, or 10%.

The Cap Rate is a very common and useful ratio for multi-family investors in a few ways. First, it can and often is used to quickly compare the potential value of two similar properties by giving you a quick ROI.

Taken in aggregate, Cap Rate can also be looked at as a trend to predict future market conditions. If cap rates in an area or type of property you are watching are compressing, it likely means that values are being bid up and a market is heating up. Where are values likely to go next year? Looking at historical cap rate data can quickly provide insight into the direction

of valuations.

Condo Conversion Equity

This is another valuable estimate that MultiFamilyProperties.com prepares for each listing. It’s a measure of the value of the property if it was converted into Condos instead of rented out. Understanding the potential value of the units sold separately is another good way to compare multiple properties and also to evaluate trends in specific geographic markets.

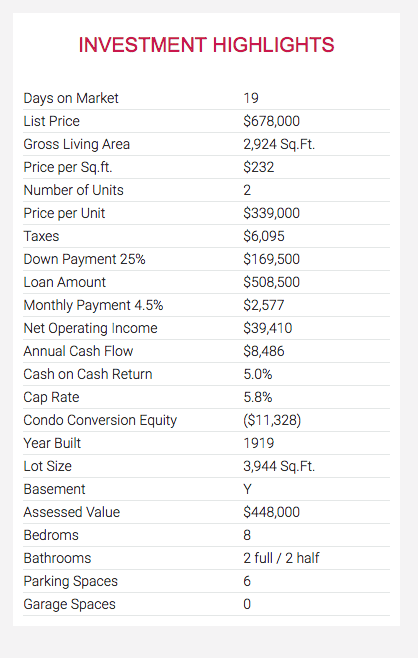

Other Important Investment Highlight

- MultiFamilyProperties.com also provides quick ‘back of the napkin’ estimates for other key factors for investors, including:

- Price per unit: What are you paying for each unit in your building on average? You can compare this to similar single unit condos to see how much of a discount you’re getting by “buying in bulk”. This is also useful for comparing the cost of various multi-properties to each other.

- Down payment: The website can help you decide how much cash you will need up front based on a down payment at 25% (if you’re a first-time homeowner, call us and you probably put down a LOT less.)

- Price Per Square Foot: Again, a good way to compare various opportunities.

- Monthly Payment: Understanding what the mortgage is going to cost you every month is a pretty important factor.

- Each investor is different and what is a good investment for one may not work for another. MultiFamilyProperties.com can help every investor quickly and easily evaluate an opportunity and identify the properties that they determine to be worthwhile.

To see these key investment highlights in action, or to search for properties that fit your needs, create a search for yourself. There are no passwords to remember, no accounts to set up, you just need an email and you are ready to go.